Sell your eCommerce Products in the U.S. - All Remotely

Are you ready to take your eCommerce business to one of the world’s largest and most lucrative markets? Unlock the U.S. market without leaving your home.

Get step-by-step guidance

Get Step-by-Step Guidance for Selling in the U.S.

My consultation program offers a roadmap to help you expand your eCommerce business into the U.S. market. Everything I share comes from years of hands-on work and research, running my own 7-figure eCommerce business in the U.S. remotely. Here’s what you’ll get:

U.S. Company Formation

Find out exactly how to set up a U.S. company as a non-resident, take advantage of tax benefits, and get a clear understanding of the costs involved to keep more of your profits.

Regulatory Guidance

I’ll guide you through U.S. regulations step by step, so you can have your business set up and ready to start receiving products in under 30 days.

Launch Resources

Get all the essential tools and resources to hit the ground running, from company formation to fulfillment, taxation, and everything else you need to sell in the U.S.

Ongoing Support

I’m here to provide ongoing help for any questions or issues as you set up your U.S. operations and get your products ready for this huge market.

Why the U.S. Market?

The U.S. isn’t just any market — it’s a $1 trillion eCommerce powerhouse. And users are ready to buy.

The U.S. consumer base is massive

-

Over 230 million active online shoppers and an average spend of $3,800 per person each year.

-

Over 80% of Americans shop online, giving you access to a vast, engaged audience. U.S. shoppers spend more than most, meaning bigger orders and higher revenue potential.

-

A strong presence in the U.S. not only boosts your revenue but also solidifies your brand’s global credibility which enable rapid growth.

Why Work With Me?

I’m not just another consultant — I’m an entrepreneur who’s been where you are. If you want actionable steps from someone who’s lived this journey, here’s why I can help you succeed:

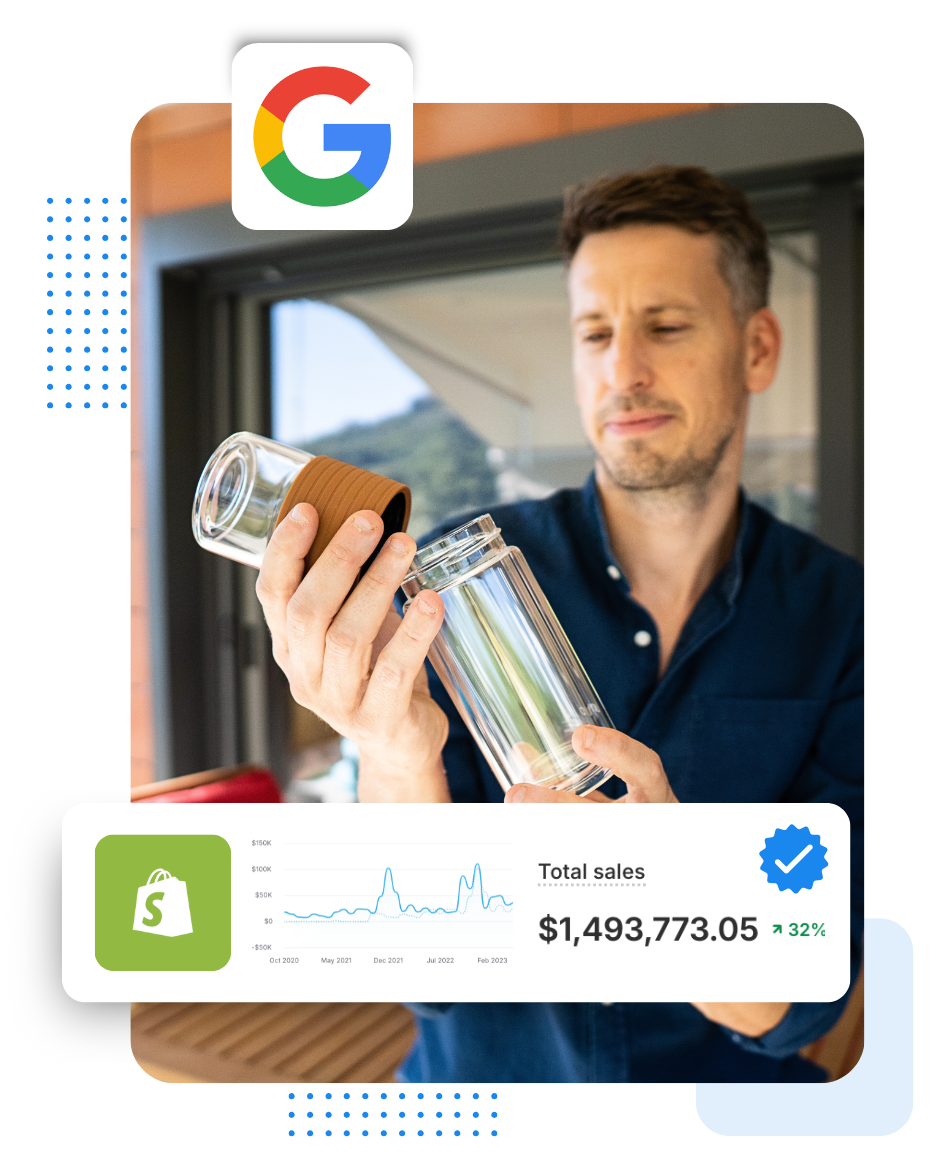

20 Years in Tech: with over 20 years of experience, including 11 years in senior management at Google, I’ve mastered building scalable businesses through sales and program management.

I've Done it: I’ve founded three companies and currently run a 7-figure eCommerce business in the U.S. remotely. I built everything from scratch, with no outside funding, and know exactly what it takes to succeed on your own.

Real-World Expertise: Unlike many offering courses, my program is based on years of real experience. The demand for advice over the years pushed me to create this program, and now I’m ready to share my expertise with you.

3.8k

Dollars spent yearly by each American buyer

230

Millions of Americans who regularly shop online

80%

Percentage of online buyers in the United States

Who Is This Program For?

You Own an eCommerce Business

You have an established business, and you believe your product has the potential to thrive in the U.S. market—one of the largest eCommerce markets in the world.

You Need to Build a U.S. Presence Remotely

You don’t need to be in the U.S. to succeed there. Whether you’re based in Europe, Asia, or elsewhere, this program shows you how to establish a strong U.S. presence without setting foot in the country.

You Need Practical, Step-by-Step Guidance

Navigating U.S. market entry can feel overwhelming, especially when it comes to company formation, tax, and logistical hurdles. This program aswers all your questions, so you can confidently launch your business in the U.S.

Questions? Look Here.

Your guide to expanding your eCommerce business into the U.S. Market, Remotely

-

How Can I Start Selling Products in the U.S. from Abroad?

If you're looking to sell in the United States but don’t live there, you’re not alone. Many successful eCommerce businesses are run entirely remotely by non-residents. My program offers a step-by-step approach to guide you through the entire process, from setting up a U.S. company to understanding U.S. regulations, logistics, and tax advantages. You’ll also learn how to market your products, manage fulfillment, and ensure smooth delivery — all without needing to be physically present in the U.S.

-

How Do I Set Up an E-Commerce Business in the U.S.?

To start an eCommerce business in the U.S., you’ll need to address several key elements: company formation, tax registrations, compliance with U.S. laws, and establishing a logistics network. Setting up a U.S.-based business can feel daunting, especially when you're navigating regulations from abroad.

My program simplifies this by walking you through the entire process. From incorporating your business as a non-resident to managing U.S. taxes and ensuring your company is legally prepared to sell in the U.S., we’ll cover everything so you can start selling quickly and efficiently.

-

What Are the Requirements to Sell in the U.S. as a Non-Resident?

Selling in the U.S. as a non-resident involves complying with specific legal requirements, including registering for a U.S. tax ID, setting up a legal entity, and adhering to sales tax laws. My consultation program provides detailed guidance on all of these aspects, ensuring that you are fully compliant with U.S. laws before you begin selling.

-

Is It Difficult to Sell Products in the U.S. If I’m Based Overseas?

While selling in the U.S. from overseas can be challenging, it's entirely achievable with the right guidance. Managing eCommerce in the U.S. remotely means dealing with logistics, understanding U.S. tax laws, and marketing to American consumers. My program focuses on helping you streamline these processes so you can run your U.S. eCommerce business without ever stepping foot in the country. You’ll receive guidance on shipping, fulfillment, and handling customer service, making it easier to grow your U.S. sales from anywhere in the world.

-

What Are the Benefits of Selling in the U.S. Market as a Non-Resident?

-

Selling in the U.S. market offers numerous advantages, especially for non-residents. As one of the largest and most lucrative eCommerce markets globally, the U.S. provides vast growth opportunities. My program not only covers the tax advantages of operating a U.S. business from abroad but also helps you capitalize on the high consumer spending power and demand. Whether you're looking to scale or expand internationally, the U.S. market is a key opportunity for any ambitious eCommerce business.

-

-

How Much Does It Cost to Start Selling in the U.S.?

The costs associated with starting an eCommerce business in the U.S. depend on several factors, such as the state of incorporation and the specific needs of your business. However, in general, it is very affordable, and with the right guidance, the process can be quick and efficient. My program will help you understand the costs involved so you can plan accordingly and get started without breaking the bank.

Do you have more questions about the program?

Contact me and I’ll get back to you with extra details.